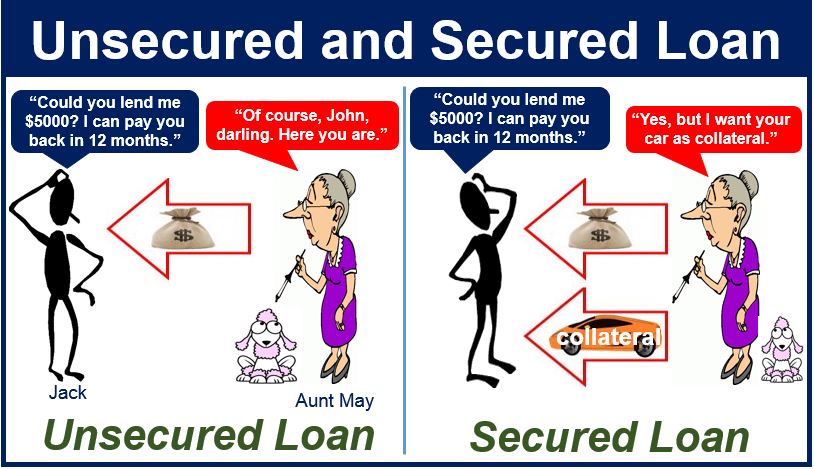

If you’re in a financial bind and need some major cash, you can get a loan. There are two types of loans – a secured loan and an unsecured loan. A secured loan is where you provide the lender with collateral or security.

This type of loan is often taken by folks that don’t have a good enough credit score to get the amount they need.. Before you decide which loan to go for, you will need to ask yourself some questions about whether your score can get you an unsecured loan or not.

If an unsecured loan is out of the question, then you have a lot to consider. Up next we’re going to tell you all about what you need to know about a secured loan and the risks involved.

What is a Secured Loan?

This is a loan you get after extending collateral to the lender. Collateral can be anything that you own that can readily be converted into cash.

The lender, based on the agreement you signed on receiving the loan, can seize this asset to repay the money that they have lent you if you don’t pay up.

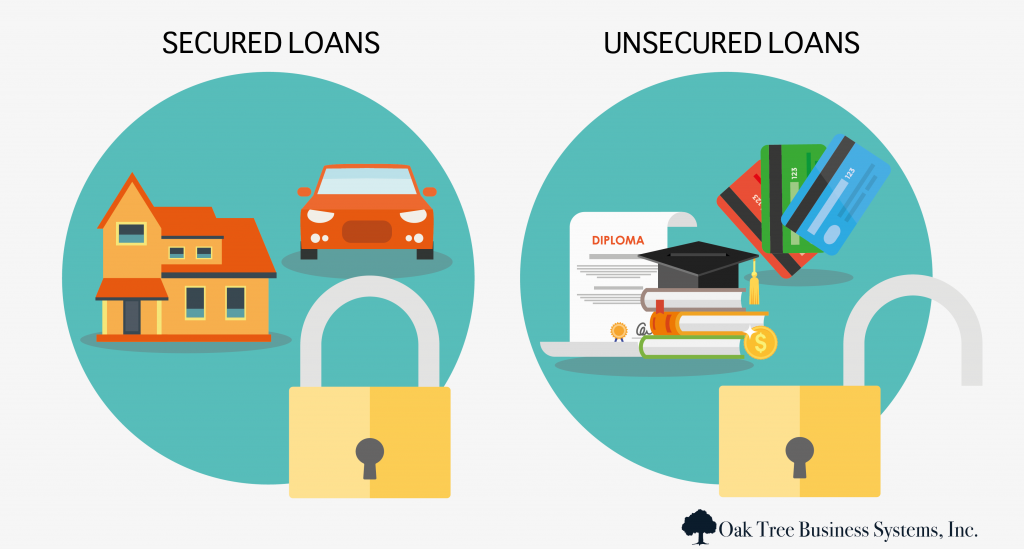

The most common forms of collateral are cars, houses, land, bonds, and stocks, among other assets. Usually the collateral you pledge is of a monetary value higher or equivalent to the loan so the lender doesn’t make any losses.

Typical secured loans include mortgages, home equity lines and vehicle loans, among others. For Home equity lines and mortgage loans, the house acts as the collateral.

Therefore, when you default or fail to pay, the lender assumes ownership of the house and you forfeit all the money you had paid so far. Similarly, the car you are buying is the collateral in a vehicle loan.

What You Should Know About Secured Loans

Lower Interest Rates

Since secured loans protect the lender from loss, then they are confident they will get their money back. You either have to repay the loan fully or forfeit your asset, either way the lender gets back his money.

It’s this confidence that enables him to extend to you the loan at a lower interest rate compared to an unsecured loan where the risks are so high.

Large Sums of Money

Since the lender is confident they will get their money back, they find no issue in extending to you large sums of money. Therefore, secured loans are usually big loans compared to unsecured loans that are usually small.

If you default, the lender either sells the collateral or keeps it which is a win-win for him. As a borrower don’t get too excited by the large sums of money involved and just rush in. Take time to think about it because you could lose your asset and some of the money too.

Therefore, be sure you can afford to pay back.

Good Collateral

There is good and bad collateral. Therefore not all types of assets will be accepted by a financial institution. Durability of the asset determines whether it’s marketable and at what value.

A durable asset means it can withstand wear and tear for a long time while a non-durable asset can easily succumb to damage. Hence, the more durable the asset, the higher the value and vice versa.

Financial institutions will take good collateral which is durable and hence is marketable.

Build Your Credit

A secured loan if paid fully or according to the agreement will help you build your credit score. Moreover, when you repay back the loan fully, you retain your collateral and build your credit score.

A good credit history is important because other lenders will consider it before giving you credit. So make sure you handle your debts before getting into a new one.

Conclusion

If you need a large amount of money to buy a home, a car or even finance your business, a secured loan can work. However, before you get it, make sure you read all the nitty-gritty.

This type of loan should only be taken if you know you can pay it back within the terms set out. Otherwise you could lose a lot.