Landing your first credit card feels great because you have that financial freedom to buy things when you please. If you are a teenager or young adult, you don’t have to rely on your parents’ credit card or financial help any longer.

However, acquiring a credit card can also mean a financial future marked with unending debt especially if you are not ready for it. When you are ready for a credit card, it means you should know the repercussions of misusing it.

There are credit reporting agencies that look into a potential customer’s history and draw their creditworthiness. This will determine whether you get that loan/ credit card or not. Read on to discover more about your credit.

Credit History

The way you handle your credit determines your creditworthiness. You don’t want to be the one with late credit payments or missed payments. When you miss a payment, you will be charged late fees that increase your monthly payment.

This money accumulates so fast and before long, you are in a deep financial pit that might take you ages to clear. Also, this portrays you as a financially irresponsible person.

As such, it might be hard for you to access a credit card or loan with any financial institution. To avoid this, ensure you pay in time your monthly credit or at least the minimum payment.

This puts you up-to-date with all your payments and will reflect in your credit report. If you do this, you will find it easy to get a credit card because banks are confident you will pay.

Credit payment history takes 35% of credit score and therefore cannot be ignored.

Credit Score

A credit score is a numerical number that lenders use to measure your creditworthiness. Usually, auto dealers, mortgage bankers, and credit card companies consider your credit score before they can grant you a credit card or loan.

Based on your credit score, they determine how much loan to give you and at what interest. Also, landlords, insurance companies, and employers may first look at your credit score before they work with you.

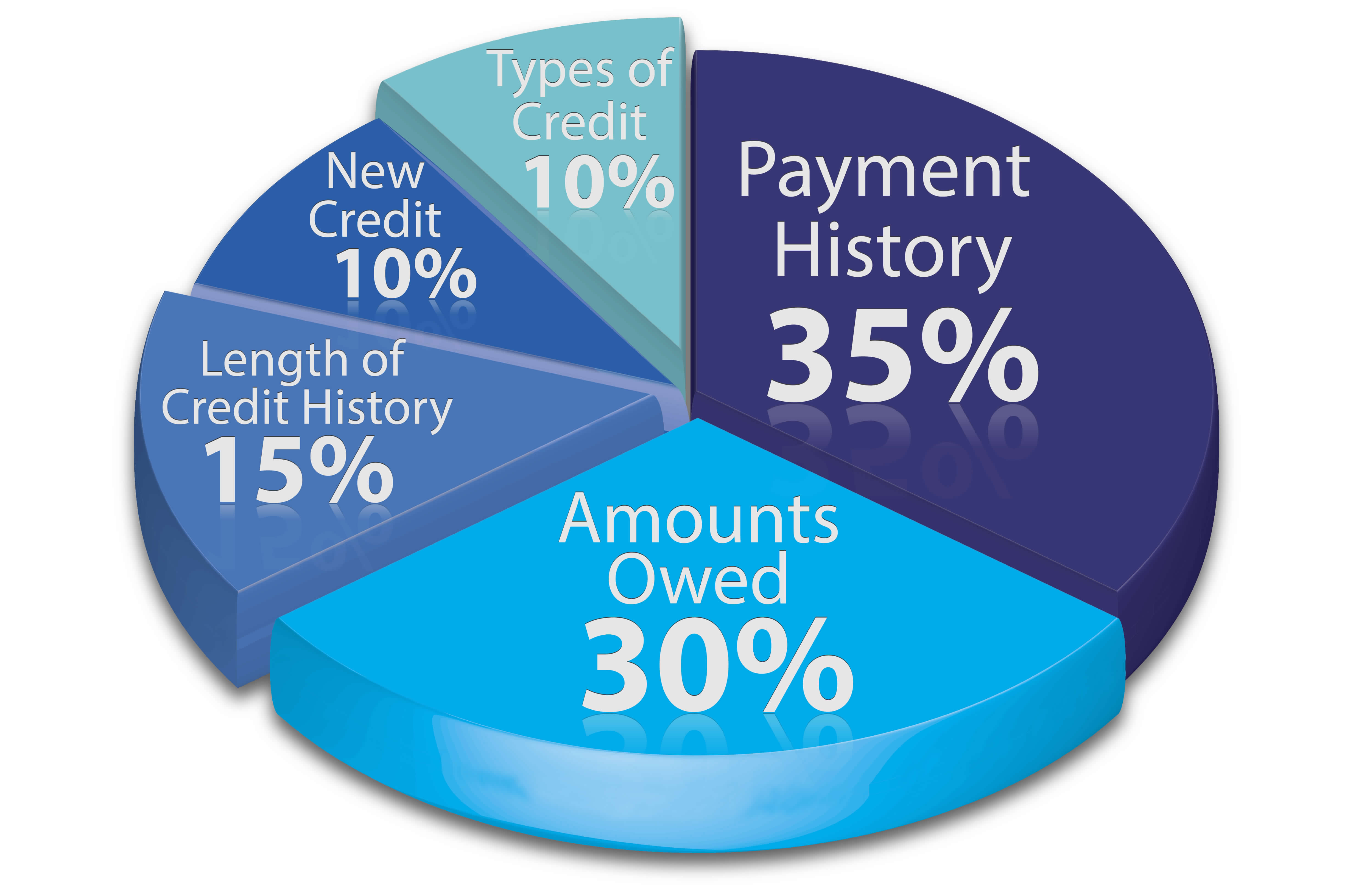

Credit score ranges from 300-850 based on length of credit history, credit history, and amount owed. Payment history contributes to 35% of the total credit score while the amount owed takes 30% and length of credit history 15%.

The higher the credit score, the higher your creditworthiness, and the lower your credit score, the lower your creditworthiness. Other factors that determine the credit score are new credit(10%) and type of credit (10%).

Credit Payment

After you receive that loan or credit card, don’t get so comfortable that you forget you have to pay back. This will lead to the accumulation of debt and will lower your credit score.

Always make it a point to pay your monthly credit or at least, pay more than the monthly minimum payment. Alternatively, schedule payment plans to assist you to pay off past due debt.

Remember, when you miss a monthly payment, you pay late charges on top of interest and premium. When you are up-to-date with your payment, it increases your credit score.

Consequently, you can get a credit card with less interest rate, fewer terms and conditions, and fewer fees. When you start on this note, it will mean more money in your pocket with very little to worry about.

Last Remark

Every financial institution will consider your creditworthiness before they render you their services. They first ascertain whether you will be able to pay their credit back before they give it to you.

This they do by considering your credit history, credit score, and payment history. You want to keep all these factors in check. Alternatively, if you don’t have credit, you will have to start with a prepaid card and build up.