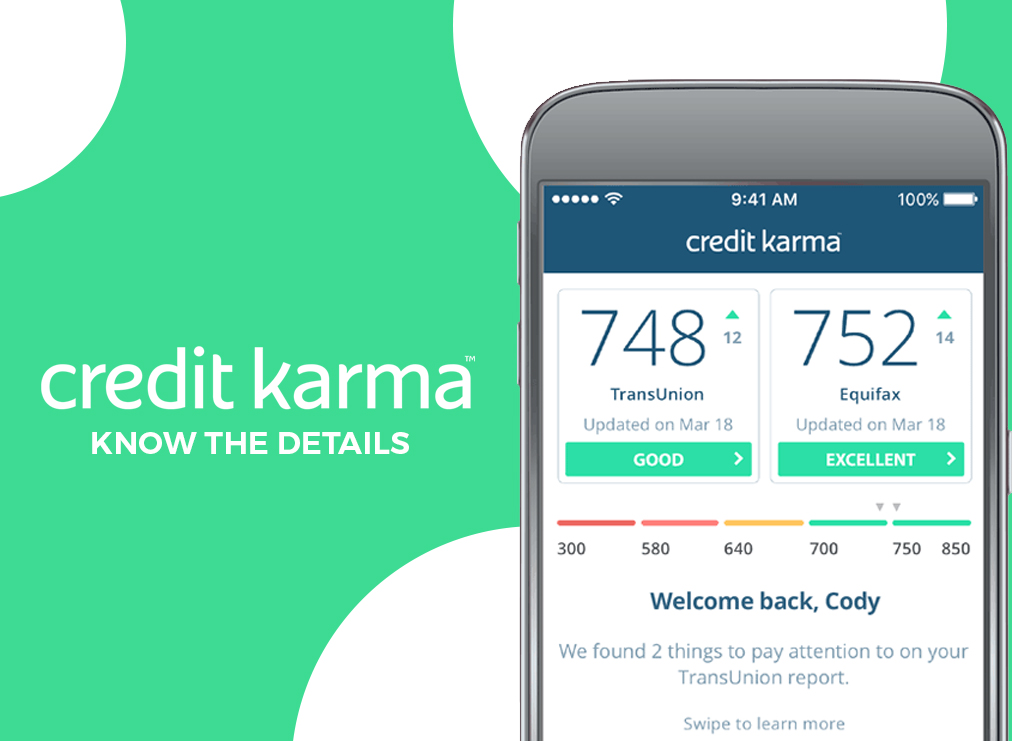

From being used to obtain housing to preferable loan rates, there’s no denying the necessity of having a good credit score. One way you can check credit scores is through Credit Karma.

Credit Karma often comes to the top of people’s credit check provider lists because they promise to provide your credit score for free. However, this service leaves many users wondering whether this free score is an accurate score.

If you are one of these people, fret not. This article aims to answer all of your questions surrounding the accuracy of your score while utilizing the said service. To know more, make sure to read on until the end.

What is Credit Karma?

Credit Karma is a personal finance firm based in the United States. It provides individuals with a free credit check by accessing your Equifax and TransUnion credit information.

Besides those things, the platform also provides users with tax preparation assistance as well as free credit monitoring.

According to its website, the company earns money off of lenders and banking institutions if individuals use the platform’s recommendations.

The recommendations and targeted ads given to you by Credit Karma are tailored based on your spending habits.

The Truth About Credit Karma Accuracy

In a nutshell, Credit Karma claims that their credit checks, and by extension, the credit scores they produce are accurate.

This is because the data they use directly comes from Equifax and TransUnion, both of which fall under the three main consumer credit bureaus in the United States.

Thanks to the information given by the two credit bureaus, the platform accurately reflects your credit score and financial information.

However, while these reflect your scores, the outcomes generated by the platform may not exactly align with the scores and reports put out by other firms.

What sets this platform apart from others is that apart from giving complimentary checks on your credit score, it also provides VantageScore independently thanks to Equifax and TransUnion.

VantageScore is a transparent scoring model that analyzes and tracks consumer credit information, making it a more accurate representation compared to the FICO score. All three credit bureaus helped design VantageScore, including Experian.

While there are differences in scores and reports put out by other firms, such as those based on the FICO scoring system, the VantageScore model leveraged by Credit Karma is said to be accurate

Accurate in that it provides actual scores based on your financial data, credit usage, and balances. Credit Karma is able to reflect actual scores from the aforementioned agencies after obtaining information such as your Social Security number.

Through this approach, they can match the data major credit bureaus have on you.

What You Need to Remember

As mentioned, the credit score released by Credit Karma is mined directly from Equifax and TransUnion. There are, however, three main factors why the scores that you see from others aren’t the same.

The first reason is that there are different credit scoring models available on the market and these can get varying results as well.

Each scoring model focuses on various factors of a person’s financial and credit history, which is why even though these may be based on the same reports, you can still get different outcomes.

Moreover, not all lending institutions and even banks support the three credit bureaus. This means the information relayed to the agencies are different from one another, thus may yield differing credit scores.

Lastly, Credit Karma only updates its scores once a week, which may cause your credit score to vary from time to time. This fluctuation, if you will, also depends on the ability of Equifax and TransUnion to update their reports.

Conclusion

Credit Karma is a reputable source for obtaining a free credit check and knowing your credit score. With its partnership with two out of three of the major credit bureaus, you’re guaranteed to get transparent information when you need it.